Do you want to invest in robots? You will benefit from tax relief!

JUNE 4, 2020

Robots are becoming an increasingly common support for employees of companies representing various industries. Their help proves invaluable in difficult, repetitive and precise work, and using them may be even more profitable in the near future. It turns out that the Ministry of Development is preparing pro-investment package for entrepreneurswho decide to robotization of workplaces. What can a business owner really count on?

Are you investing in robots? You can count on discounts

The first mention of plans to help entrepreneurs who decide to... robotization of workplaces, appeared at the beginning of 2020. The Minister of Development, Jadwiga Emilewicz, informed about the emerging pro-investment package for small, medium and large enterprises. This is mainly about relief taxation which is to cover expenses for the purchase of various types of robots to support the production process and:

- 3D printers;

- digitally controlled production machines;

- specialized software;

- VR (virtual reality) devices for design or production;

- training employees in the use of the above-mentioned solutions.

In practice this means that From next year, entrepreneurs will be able to deduct from their income all expenses resulting from the robotization of workplaces and production automation. This is intended to be an incentive for business owners to invest in new technologies and increase the chances of developing enterprises in various industries - automotive, electronics, agriculture, food industry and many others.

The new regulations - which will be very similar to those in force regarding tax preferences for research and development (R&D) - will also include other benefits for entrepreneurs. This includes, among others, a six-month leave for start-ups, which will not burden their owners with direct financial costs, or the principle of tax liability only when a dividend is paid. It should be remembered that these are only plans for now - we will find out what the final shape of the pro-investment package will be in the coming months.

Tax reliefs are to be effective from January 1, 2021, and the draft bill, which is being worked on by the Ministries of Development and Finance, is to be adopted by the Polish government by the end of September this year.

Who will benefit from tax breaks?

Support is addressed to both small and medium-sized enterprises, as well as large enterprises dealing primarily with production. It will be used by business owners who want to focus on modern, innovative technological solutions, allowing you to automate production and support employees in the most tedious and repetitive activities.

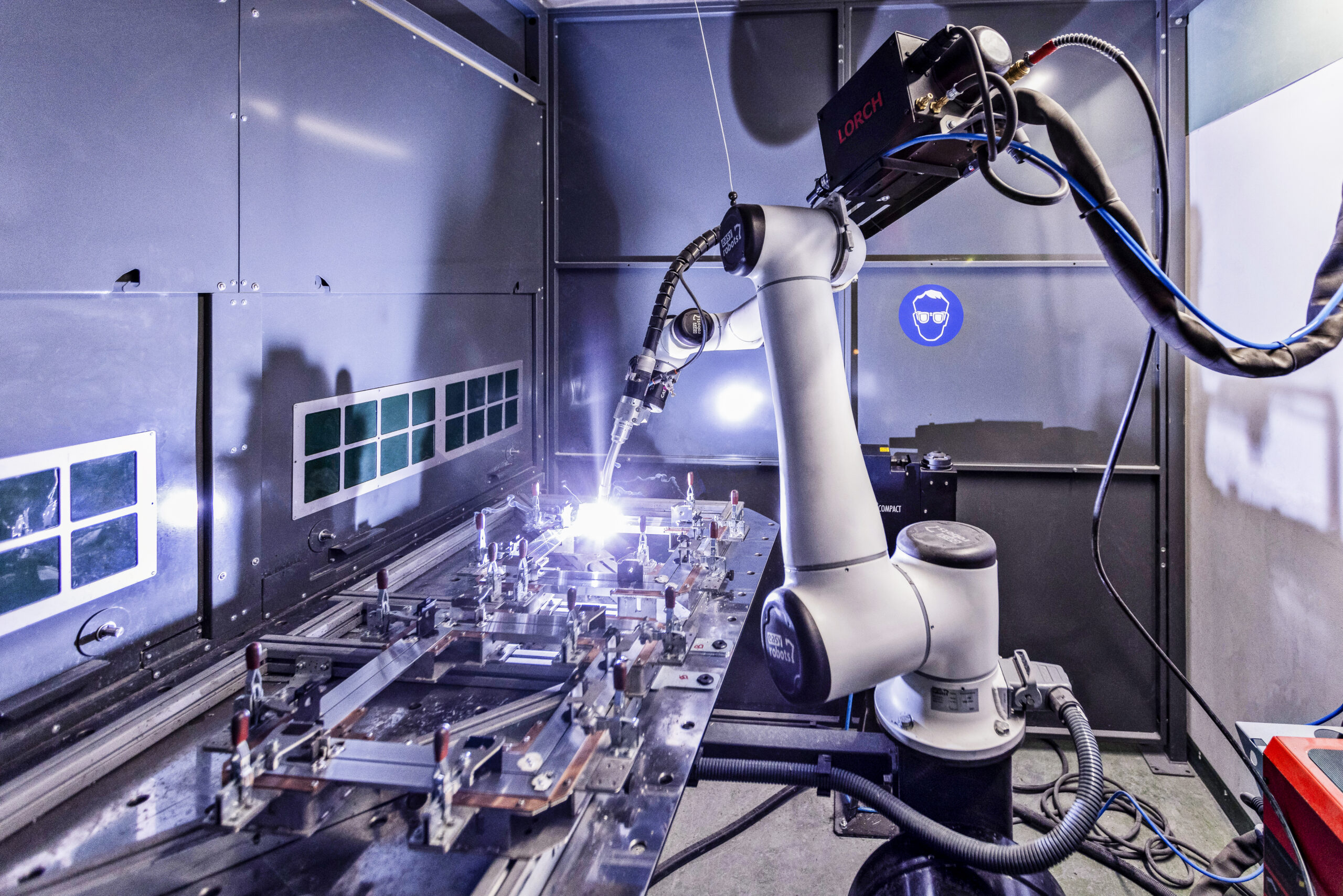

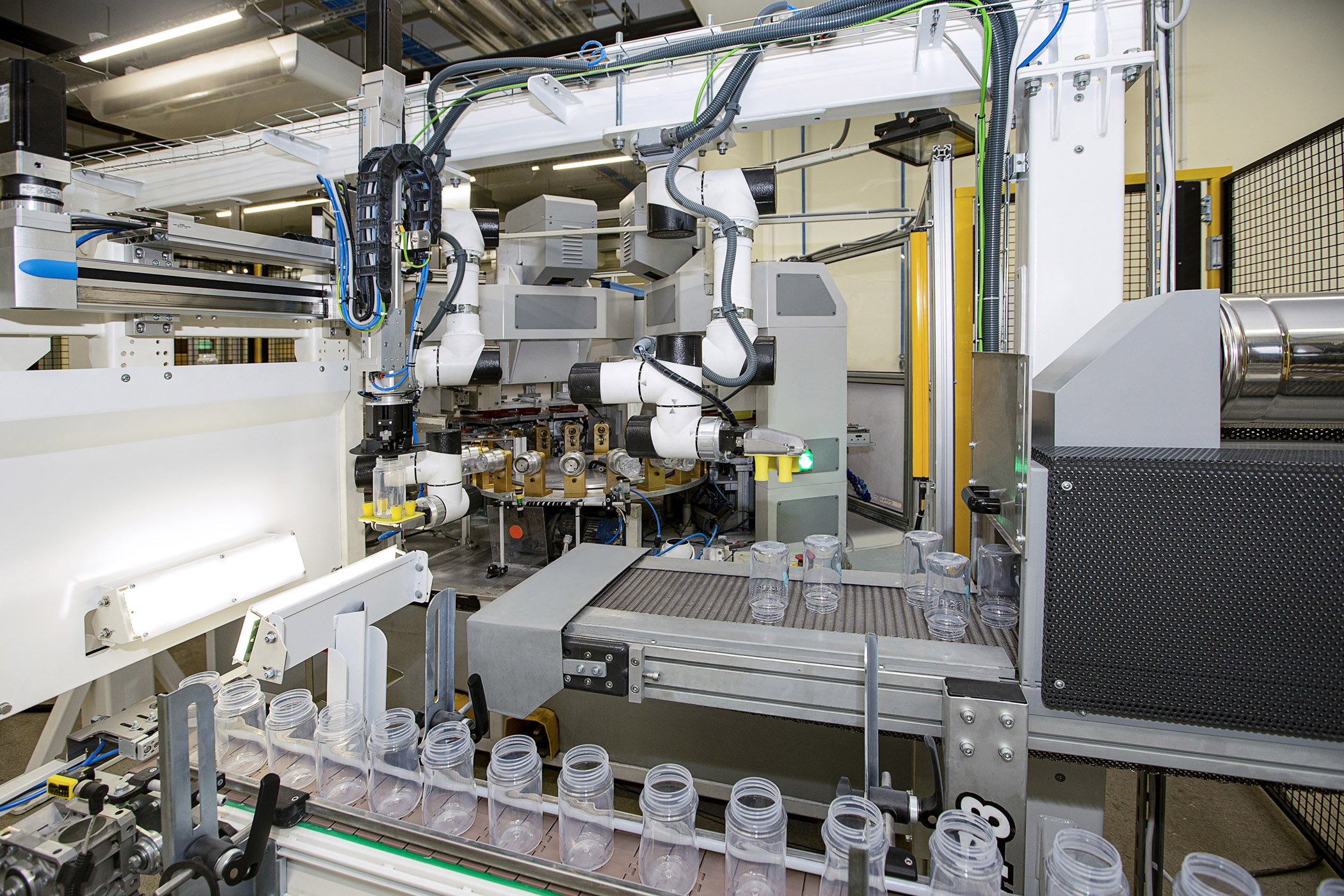

Robotization of workstations and the purchase of specialized devices cooperating with people has a huge impact on increasing the efficiency of activities and relieving employees. Thanks to technologically advanced machines, for which the entrepreneur will pay less, it is possible, among other things:

- more efficient sorting, palletizing and packaging of various types of products;

- more precise welding, turning and milling work;

- automation of drug control and packaging, and much more.

You can read about which industries can count on the support of robots the most and will therefore be most likely to benefit from the new tax reliefs in this place.

So far, it has not been determined how much support for entrepreneurs will be. Arrangements are still underway with the Ministry of Finance regarding the amount of tax relief - all we know is that the project being prepared is to allow for tax deduction of expenses for robotization of workplaces in a favorable proportion. The details, as well as the shape of the entire act, will most likely be known in the coming months.

Why is support so necessary?

Robotization of workstations and production automation bring huge benefits in the long run - they will not only increase the quality of activities, but will also generate large savings. However, the problem that many entrepreneurs face is the investment in robots and modern software. This requires very large financial outlays, which often prevent business owners from making investments. Thanks to state aid, the purchase of high-efficiency equipment will be much lower.

Supporting robotization by introducing appropriate tax reliefs is therefore crucial in the development of Polish enterprises. And most importantly, it is an effective solution, as has been proven in France, Italy and South Korea, where similar aid instruments for developing companies have been implemented.

Good to know! We are currently observing a dynamic increase in wages in our country, which is associated with increased labor costs. One of the best ways to reduce them is to use the support of robots. Robots do not get sick, do not form trade unions, and can work 24 hours a day.

Tax reliefs are also valuable in times of crisis

It is also worth mentioning other problems that will result in necessity robotization of workplaces. We are talking here about demographic changes that have been taking place for several years, and more specifically - the aging of society, as well as the approaching economic crisis caused by the current situation in the world. There is a high probability that as a result of the virus pandemic, many entrepreneurs will have to look for new solutions to not only ensure the development of the company, but also maintain their position on the market.

In that case Top-down support in the form of tax breaks can be a lifeline for many companies.

Robotization of workplaces – an opportunity that cannot be missed!

Support plans for entrepreneurs result primarily from the fact that too few companies still decide to automate production processes and use robots and modern software. And though robotization of workplaces progress in our country, we are not doing well in this respect compared to other countries. To understand this, it is enough to quote the statistics found in the report of the Polish Economic Institute "Roads to Industry 4.0. Robotization in the world and lessons for Poland” – at the end of 2018, a total of just over 13.5 thousand robots were working in our country. In the Czech Republic, which is smaller than us, this number is over 17,000, and in Germany - 215,000. Going further - in Poland there are 42 robots per 10,000 employees. For comparison, in Germany this number is 338, in the Czech Republic 135, and in Hungary 84. So we lag behind not only Western European countries, but also Central and Eastern Europe.

However, a good prognosis is the fact that compared to other countries, the dynamics of robot growth in Polish companies is similar. This means that entrepreneurs in our country want to focus on new technologies - tax reliefs can make it much easier for them.

And about that robotization of workplaces is extremely beneficial, as the statistics also prove. As many as 83 percent of companies that opted for automation and robots increased efficiency and production volume, and 67 percent of entrepreneurs recorded lower production costs.

Waiting for specifics…

By investing in new technologies, you focus on development - so it is worth watching the reports from the Ministry of Development regarding the implemented tax reliefs, because they may turn out to be the key to success for many enterprises. Not only the details regarding the form of support for entrepreneurs or the amount of relief will be important, but also formal issues - e.g. what the government considers the definition of "robot" will be. This will have a major impact on the final shape of the act. Everything should be clear soon.