Loan for technological innovations - more favorable conditions from June 1!

JULY 30, 2020

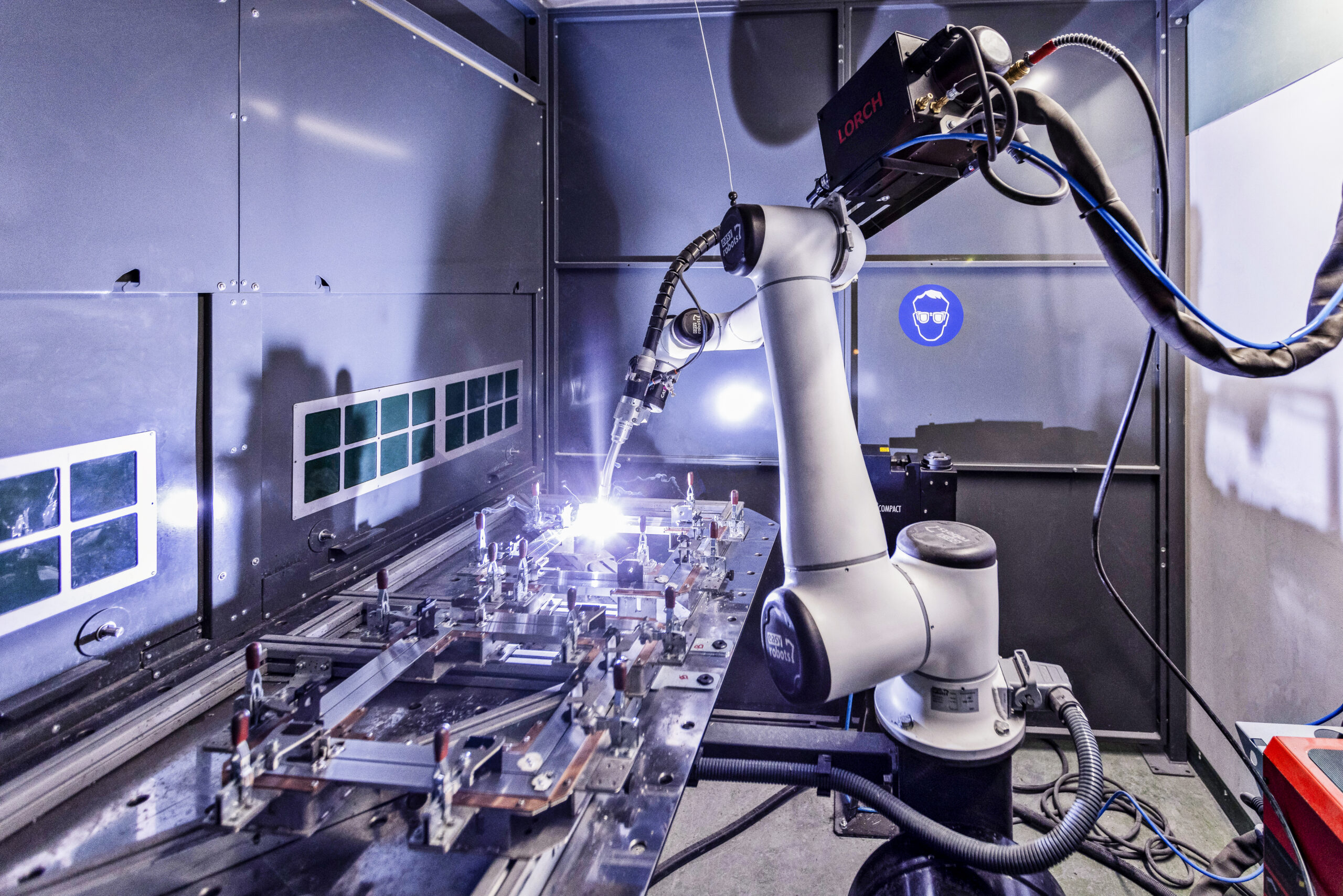

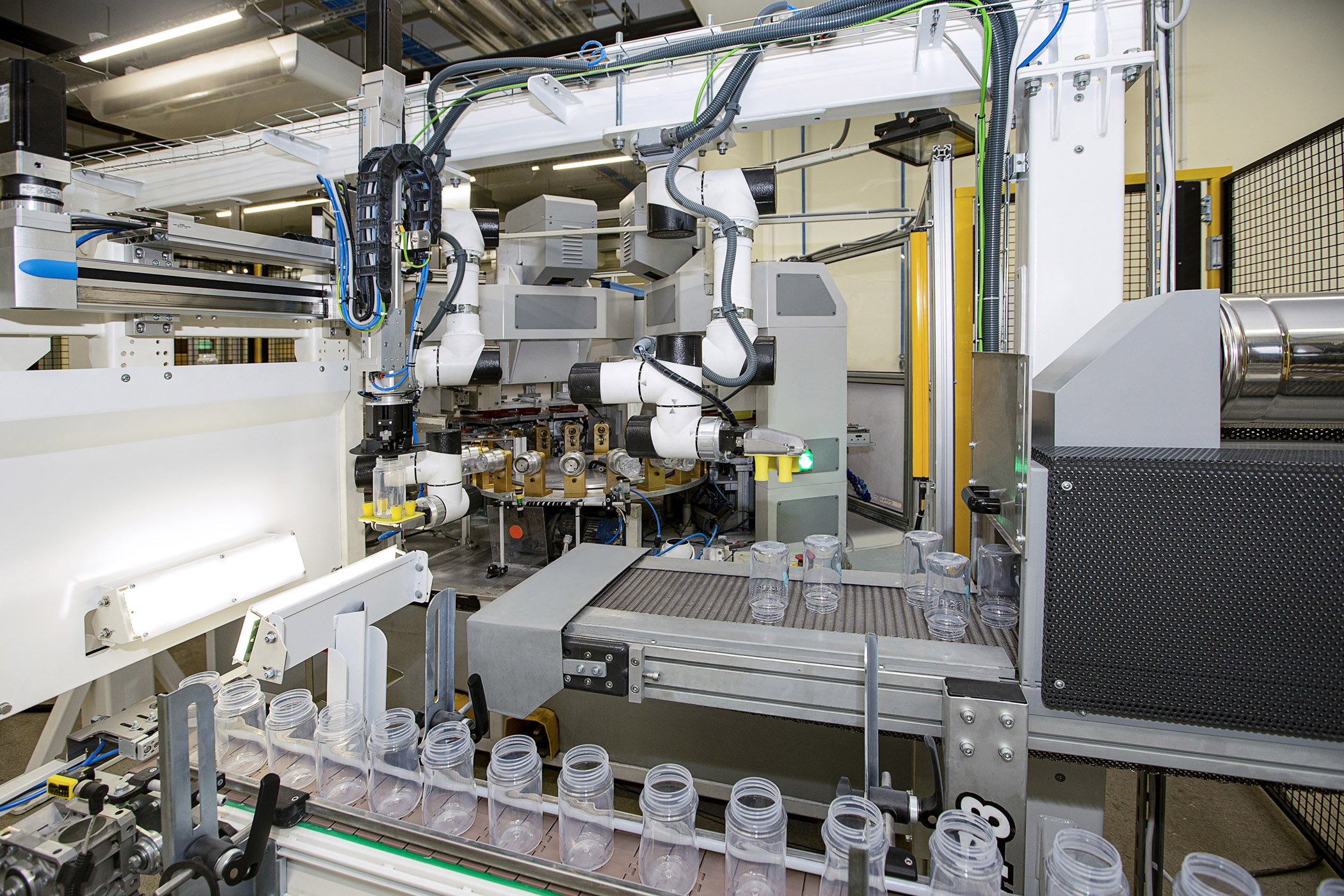

From June 1, 2020, new rules for granting innovation loans apply. From now on, entrepreneurs will be able to receive money much easier and in much higher amounts. Loans for technological innovations can be used to develop micro, small and medium-sized enterprises in various fields, such as the development of new technologies. Thanks to this, entrepreneurs can implement production robotization or invest in the latest robotics technologies.

Loan for technological innovations – EU support

A loan for technological innovation is financial support aimed at developing and increasing the competitiveness of micro, small and medium-sized entrepreneurs. It is based on a technological bonus, which is a repayment of part of a technological loan granted by a commercial bank for the implementation of an investment that is intended to support the development of new solutions in a given enterprise. This funding covers up to 70% of eligible investment costs. All funds come from the EU Smart Growth Operational Program 2014-2020.

Changes in innovation loans – what's new?

Due to the Covid-19 pandemic, the Ministry of Funds and Regional Policy - in cooperation with Bank Gospodarstwa Krajowego, the operator of the Innovation Credit program - has prepared a number of changes related to the granting of funding. At the same time, the earlier call for applications was shortened and the deadline was moved from June 24 to May 31. In this way, new rules regarding innovation loans could come into force from June 1. What's new in these changes?

Abolition of the maximum limit for technology bonuses

As of June 1, the maximum limit for technology bonuses has been abolished. Previously, there was a limit of PLN 6 million to cover investment expenditure. Currently, there is no such limitation. The amount of funding itself depends on the place of project implementation and the size of the company, but it will cover a maximum of 70% of eligible investment costs. The rest must be provided by the entrepreneur.

Possibility to introduce innovation on an enterprise scale

The previous assumptions of the loan for technological innovations assumed that the idea had to be innovative on a national scale - the entrepreneur had to demonstrate that the project he was introducing was unique and had not been duplicated. Currently, the need for innovation on a national scale has been abolished, so it can be introduced on an enterprise scale - that is, implement products and services in the company that have not been offered before.

Extension of the catalog of eligible expenses

In order to receive funding for innovation, it is necessary to meet appropriate conditions - including using the money for eligible expenses, i.e. covered by the refund. The current change has expanded their catalog, thanks to which entrepreneurs will be able to spend the funding on additional things. The following elements appeared among the new eligible expenses.

- The cost of purchasing, assembling and commissioning fixed assets as well as the costs of their transportation. From this point on, the costs of transporting machinery and equipment as well as other fixed assets, which were not covered in the previous project, will also be reimbursed. Thanks to this, the entrepreneur will be able to order machines and devices from distant places without fear that the transport costs could exceed the price of the device itself.

- Construction works and materials – for the purpose of constructing or expanding buildings – in the earlier project it was not possible to invest in buildings and real estate, especially in construction materials, and it was not possible to cover the costs of the construction team.

- Purchase of intangible assets in the form of patents, licenses, know-how and unpatented technical knowledge – previous regulations only defined the possibility of purchasing the necessary software without the possibility of acquiring knowledge or purchasing patents and other intangible items necessary to introduce innovations;

- Studies, expert opinions and technical projects necessary to implement a technological investment prepared by external advisors – previously, the entrepreneur had to cover all costs of necessary scientific expertise and development of technical projects. Only research and expertise performed by the entrepreneur himself were financially covered - provided he had appropriate scientific and technological resources.

- Costs of renting and leasing land, buildings and structures – this is a very big change. The earlier project assumed that the entrepreneur had to finance all real estate himself, regardless of whether it was purchased or leased (or rented). The current change will increase the opportunities for entrepreneurs to purchase real estate for the development of their enterprise.

Abolition of the obligation to make your own contribution to the project

In the earlier version of the co-financing, it was necessary to provide own contribution 30%. Currently, this is also one of the conditions for granting funding, but there is an exception. If the entrepreneur demonstrates that his creditworthiness allows it, the bank that will grant a loan for the investment may grant a technological loan to finance up to 100% of the project value. Thanks to this, many companies will be able to apply for a loan much earlier, because they will not be limited by the need to make a 30% contribution to the investment - which amount would have to be collected from their own revenues.

How to get the technology bonus?

An entrepreneur who wants to obtain a technology bonus must first submit an application for a technology loan at any commercial bank. Then, after obtaining a promise or concluding a conditional loan agreement, he or she submits an application for project financing to Bank Gospodarstwa Krajowego (during the competition). If approved, BGK grants a promise of a technological bonus, and the entrepreneur signs an agreement with the bank. Then, Bank Gospodarstwa Krajowego signs a project co-financing contract with the entrepreneur and pays a technological premium as part of interim payments, as well as as part of the final payment, after the project is completed.