Reliefs and subsidies for robotization – the most important questions and answers

The act on relief for robotization has become a fact. It entered into force on January 1, 2022 and will be valid for the next 5 years (until 2026). It is intended to encourage entrepreneurs to invest in production automation systems and the latest technologies, but its rules are not clear to everyone. That's why we decided to collect the most important information in one place and answer the most important questions of business owners. We invite you!

How much is the robotization tax relief?

Business owners who are PIT or CIT payers who have invested in robotization have the opportunity to deduct it 50% tax deductible costs in the annual settlement. This includes all costs incurred - depreciation, services, training and modernization works related to robotization.

The relief is available from January 1, 2022 to December 31, 2026 - the sooner the depreciation of the installation is started, the higher the amount the entrepreneur will deduct.

Who can benefit from the robotization tax relief?

The tax relief for robotization applies to: all CIT and PIT taxpayers conducting non-agricultural business activities – regardless of the size of the company or type of activity.

The condition is, of course, investing in robotization and settling the depreciation of used devices at the end of the year using the appropriate PIT form.

Does the relief cover works purchased before 2022?

Yes, but only if it was robot corresponding to the definition in the Act and factory new (operationally leased equipment is not covered by the relief).

In such a situation, the entrepreneur can settle all costs related to depreciation or modernization of the robot incurred from January 1, 2022 under the relief.

How are works covered by relief defined?

To benefit from the robotization tax relief, used industrial robot must comply with the definition in the Act. Below we present the most important conditions that the device must meet to be able to benefit from the relief.

- An industrial robot is stationary or mobile automatically controlled, programmable, multi-tasking machine at least 3 degrees of freedom, which has manipulation or locomotion properties.

- An industrial robot should exchange data in digital form with control and diagnostic or monitoring devices, which will allow it to be remotely controlled, programmed, monitored or diagnosed.

- An industrial robot should be connected to IT systems that improve production processes – these include production management systems as well as product design and planning systems.

- An industrial robot should be monitored using sensors, cameras or similar devices.

- An industrial robot should be integrated with other machines involved in the production cycle.

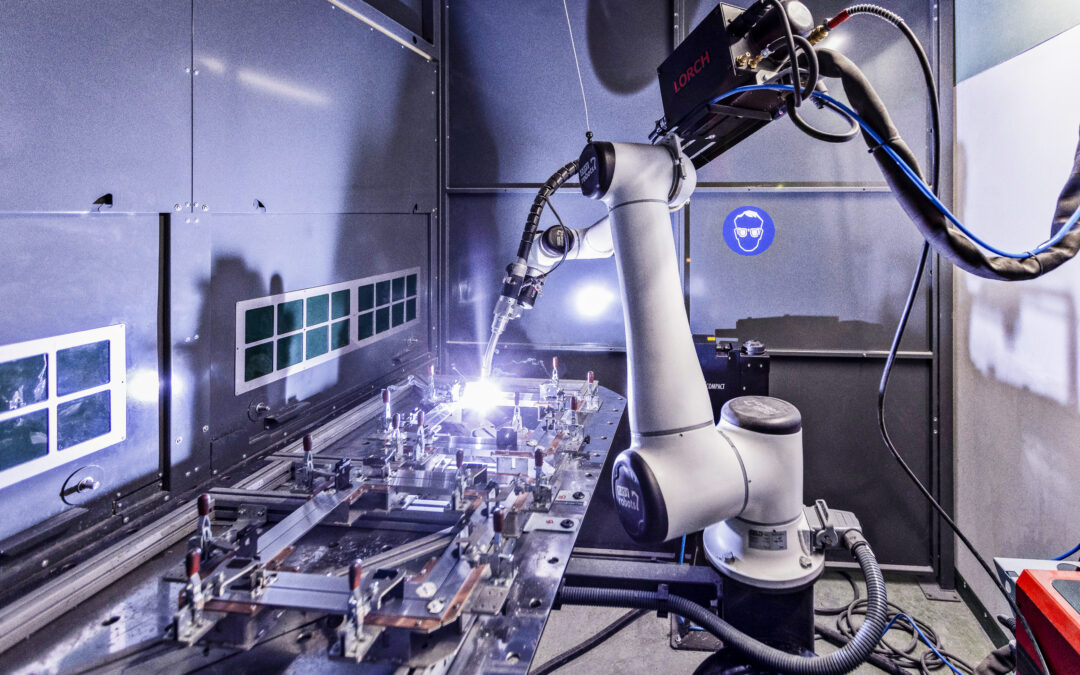

IMPORTANT! Industrial robots available in our offer meet the statutory definition, therefore they may be covered by the robotization relief.

What devices can be included in tax deductible costs for robotization relief?

First of all, these are the costs of purchasing brand new ones (ones that have never been used before). of industrial robots, and:

- machines and peripheral devices functionally related to an industrial robot;

- machines and peripheral devices related to the industrial robot that are used to ensure ergonomics and safety at individual workstations (these include sensors, controllers, relays, safety locks, physical barriers, e.g. fences, and optoelectronic protective devices, e.g. light curtains) ;

- machines, devices and systems enabling remote management, diagnosis, monitoring or servicing of industrial robots (these include primarily cameras and sensors);

- devices for industrial robots enabling interaction between humans and machines.

What else is considered tax-deductible costs incurred for robotization?

1) Costs of purchasing intangible assets necessary to launch and use industrial robots (and other machines mentioned above) - this includes software licenses or the costs of implementing a robotic station.

2) Acquisition costs training services regarding training robots and other machines or intangible assets – we are talking about learning how to operate a robotic station (and not general training related to transferring knowledge about industrial robots).

3) Fees resulting from taking the robot or the entire installation into financial leasing – the condition for taking advantage of the relief is that you retain ownership of the fixed assets after the end of the leasing period.

Where to get funds to invest in robotization?

The robotization relief is not the only financial instrument that provides support to Polish entrepreneurs implementing new production technologies. It is also possible to take advantage of subsidies - thanks to them you will significantly reduce investment costs and will be able to more easily use the potential of industrial robots in your company.

There are several options at your disposal, the most important of which are:

- National Reconstruction Plan (KPO), under which it is possible to obtain funding or a loan for the implementation of smart production lines and the construction of smart factories;

- subsidies from the New Financial Perspective, which include, for example, the FENG program designed to provide entrepreneurs with support in the implementation of industrial robots and automation of production processes;

- solutions of the Polish Investment Zone (PSI), which may facilitate the purchase or leasing of machinery and equipment, including industrial robots - entrepreneurs can count on support in the form of tax exemption (even 70% eligible costs);

- Robogrant, i.e. a non-refundable financial instrument under which it will be possible to obtain up to PLN 850,000 for the purchase of industrial robots and devices functionally related to them - this is an initiative dedicated to companies from the furniture industry.

What is Robogran funding?

Robogrant is an initiative initiated by the Polish Agency for Enterprise Development (PARP), which continues programs that have proven successful in previous years and provide support to entrepreneurs investing in new technologies, e.g. Industry 4.0.

Under the program, the maximum value of eligible expenses is PLN 1 million, a maximum value of funding can amount up to PLN 850,000.

The call for applications is planned to be announced in the second quarter of 2022. With funding Robogrant they can benefit micro, small and medium-sized enterprises manufacturing companies operating under PKD 31.

What can Robogran grants be used for?

Funds from Robogran can be used for purchases of industrial robots, as well as all types of technologies that allow for their effective operation. This includes, among others:

- machines and peripheral devices that are functionally related to industrial robots;

- machines, devices and systems functionally related to industrial robots, which ensure safety and ergonomics of work;

- machines, devices and systems enabling remote management, diagnosis, monitoring and servicing of industrial robots (such as sensors and cameras);

- devices enabling interaction between humans and industrial robots.

Moreover, funding may also be used to cover various types of costs - e.g. the purchase of intangible assets that are necessary to launch and implement industrial robots, as well as training services related to the operation of these devices.

What forms of subsidies will be available in the future?

The development of robotization means that entrepreneurs will be able to use many forms of support in the coming years. The Polish Agency for Enterprise Development will be involved in the implementation of as many as: three operational programs and the one mentioned earlier National Reconstruction Plan.

It is worth paying particular attention to plans related to European Funds. They will include competitions in programs such as:

- European Funds for a Modern Economy (FENG);

- European Funds for Eastern Poland (FEPW);

- European Funds for Social Development (FERS).

PARP will allocate EUR 5 billion for the implementation of all activities. Most of the subsidies will be dedicated to enterprises, so it is worth following the development of the situation - thanks to this, you will have a greater chance of growing your company and implementing modern technologies.